In the bustling world of international trade, bonded warehouses play a crucial role in facilitating the movement of goods across borders. These specialised facilities offer a unique environment where goods can be stored, processed and even manipulated without incurring customs duties or taxes until they are ultimately released into the domestic market. For warehouse managers, understanding the intricacies of bonded warehouses is essential for optimising supply chains and ensuring compliance with regulations.

What Is a Bonded Warehouse?

At its core, a bonded warehouse is a secure storage facility that operates under a customs bond. This bond is a guarantee provided by the warehouse operator to the customs authorities that all goods stored within the warehouse will be accounted for and released in accordance with regulations. By using bonded warehouses, importers can defer the payment of customs duties and taxes until the goods are ready for domestic distribution.

Distinguishing Bonded from Non-bonded Warehouses

The primary distinction between bonded and non-bonded warehouses lies in their relationship with customs duties and taxes. Non-bonded warehouses are subject to immediate customs clearance upon the arrival of goods, meaning that import duty and taxes must be paid upfront. This can pose a financial burden for importers, especially for high-value or high-volume shipments.

In contrast, bonded warehouses offer a temporary respite from these financial obligations. Imported goods can be stored in a bonded warehouse without incurring duties or taxes, providing importers with the flexibility to manage their cash flow and optimise their supply chains.

How Bonded Warehouses Operate in the UK

The operation of bonded warehouses in the UK is governed by the Customs and Excise Management Act 1979 and associated regulations. Warehouses are typically licensed and operated by private companies that have undergone rigorous security checks and compliance audits.

To utilise a bonded warehouse, importers must enter into a bond agreement with the warehouse service provider. This agreement specifies the types of goods to be stored, the duration of storage and the procedures for releasing the goods.

Types of Goods Typically Found in a Bonded Warehouse

A bonded customs warehouse is an ideal solution for many types of goods for several reasons and alcohol is a great case in point. Indeed, for alcoholic drinks importers, bonded warehouses play a crucial role.

With the rise in popularity of craft beer and artisan wines, and spirits, pubs, restaurants, shops, and supermarkets are in the market for high-quality overseas imports. Indeed, according to The SIBA Craft Beer Report 2022, 33% of consumers now drink international craft beer, while 62% favour global larger.

(Image source: cask-marque.co.uk)

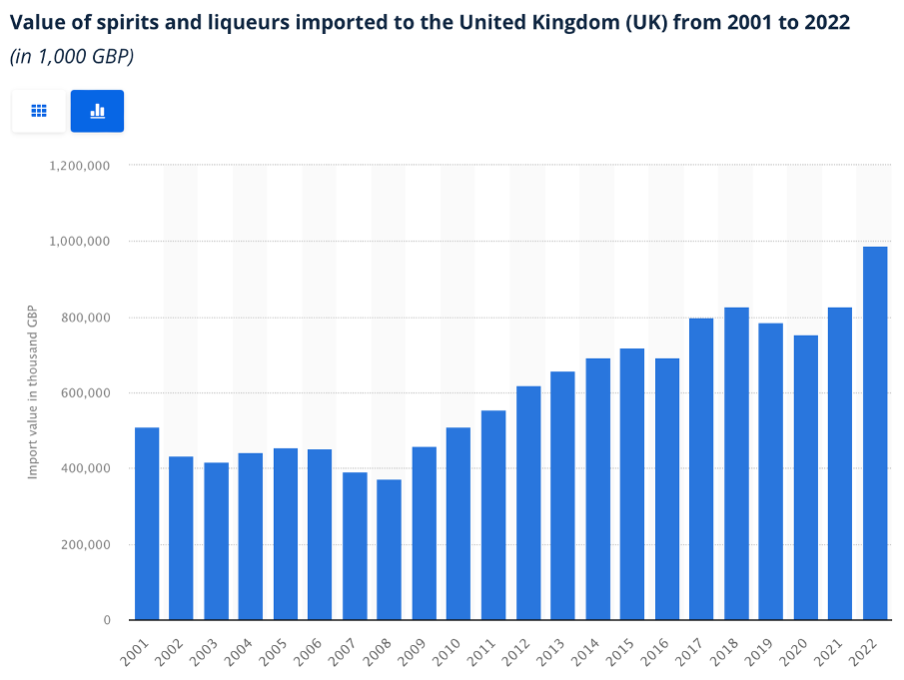

Meanwhile, imports of spirits and liqueurs have never been higher, valued at a massive £988 million in 2022, a huge increase over 2021’s value of £827 million.

(Image source: statista.com)

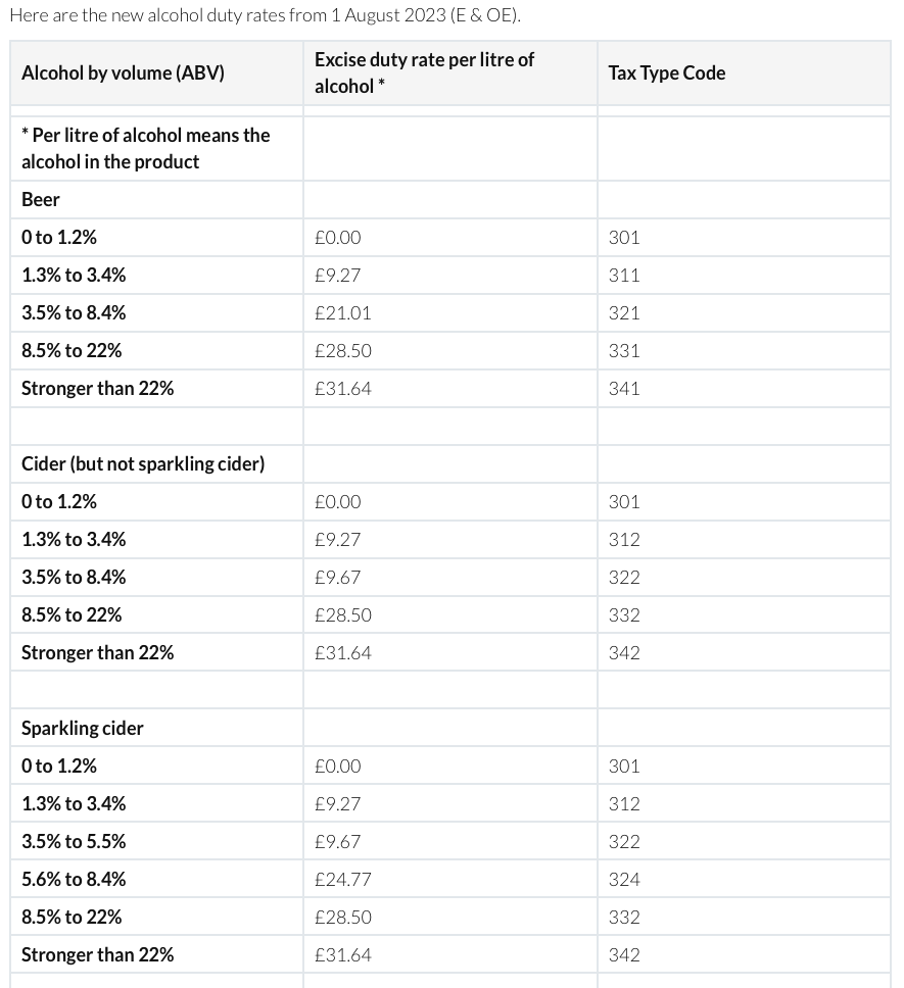

However, all importers must pay duties to the customs authority on their wares, and excise duties on alcoholic beverages are substantial. As such, having the ability to postpone payment of these duties can be hugely beneficial to a business’s cash flow, and this is precisely what using a bonded warehouse allows you to do.

As of August 2023, alcohol duty rates are calculated with a new Alcohol by Volume (ABV) system, which essentially means beverages with a higher alcohol percentage are subject to a higher rate.

(Image source: strongandherd.co.uk)

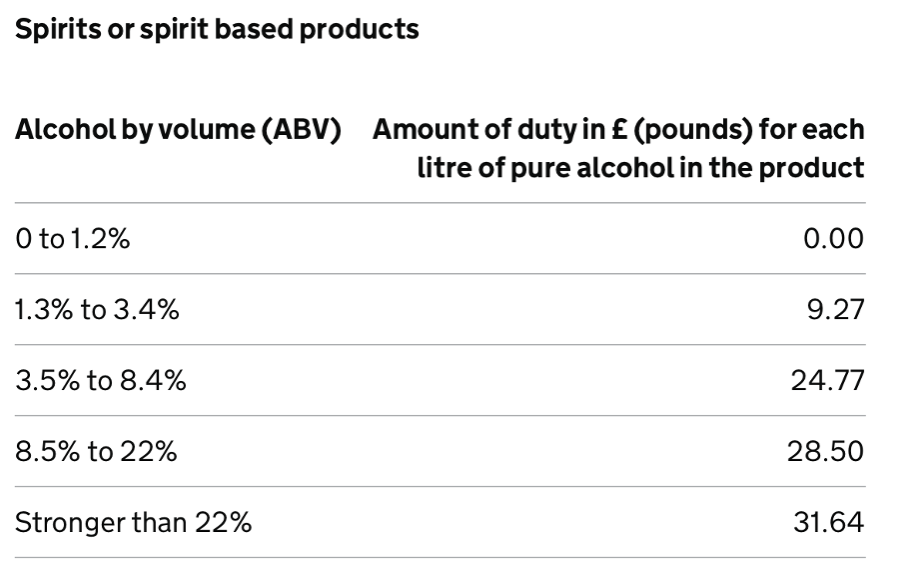

For spirits the duty rate is as follows:

(Image source: gov.uk)

With such high duty, importers can be left feeling unable to buy in bulk and access high-volume discounts from suppliers.

For example, if an importer wanted to buy 10,000 litres of gin at 40% ABV, this would equate to 4,000 litres of pure alcohol at £31.64 per litre. The alcohol duty to be paid for this import would therefore be £126,560.

This is a significant amount of capital that the business might not have on hand. However, by storing the gin in a bonded warehouse, the business can avoid paying the sum all at once and instead fund tax payments with income generated from sales of the gin as they’re made. This greatly improves cash flow and is a big win for the business.

Moreover, bonded warehouses provide a secure and controlled environment for storing alcoholic beverages. This is particularly important for ensuring the quality and integrity of the products, especially for high-value or limited-edition items.

The same, of course, is true for other types of alcohol and indeed other types of products that attract high customs duties and need safe and secure storage, such as:

- Tobacco products

- Gourmet chocolates

- Perfume, skincare and cosmetics

- Antiques

- Original artwork and paintings

- Coffee

- Specialty candy

- Handbags

- Watches

- Luxury clothing and accessories

- Electronics

Further Benefits of Bonded Warehousing

The benefits of utilising bonded warehouses extend beyond tax deferral. These facilities offer a range of advantages for importers, including:

- Improved customer service: Bonded warehouses allow for advanced ordering of goods, enabling timely delivery and enhanced customer satisfaction.

- Product quality preservation: State-of-the-art facilities within bonded warehouses maintain product quality through controlled environments like dry containers, temperature control systems and bulk storage options.

- Cargo security and safety: Comprehensive security measures, including CCTV surveillance, full documentation, 24/7 security personnel and rigorous audits, ensure the safety and protection of goods stored in bonded warehouses.

- Warehousing proximity to ports: Strategic placement of bonded warehouses near major ports expedites customs clearance and reduces transportation costs, streamlining the supply chain and minimising potential damage.

- Compliance with regulations: Bonded warehouses ensure compliance with customs regulations, preventing penalties and potential legal issues.

Find the Best Bonded Warehouses with FLOX

Bonded warehouses are essential components of the international trade landscape, providing a valuable service to importers and facilitating the seamless movement of goods across borders, helping you ensure a steady cash flow while protecting your wares.

If you’re looking for a platform that makes it easy to find and book a customs bonded warehouse space to store goods in the UK, your search is over. FLOX is a shared transportation and warehousing logistics platform that is dedicated to promoting efficiency, cost savings and sustainability, helping you improve operations across the board. Our platform enables warehouse managers, shippers and logistics service providers to collaborate seamlessly, driving the flow of every order and shipment. With FLOX, there’s no need to sign leases directly with warehouse owners or negotiate terms. Instead, our clients sign a standardised set of three-way Terms and Conditions between warehouse provider, FLOX and themselves, which regulates pay-as-you-go use of the warehousing space.

To try it out with no monthly fees, sign up for FLOX platform access to create an account and start shaping the future of logistics today.

FAQ

How long can goods be stored in a bonded warehouse?

Goods can typically be stored in a bonded warehouse for up to five years or more, depending on the specific warehouse and regulations in place. This duration allows businesses to defer duty and tax payments while accommodating long-term storage needs.

What costs are associated with using a bonded warehouse?

Using a bonded warehouse comes with several costs, including:

Warehouse Fees: Most bonded warehouses charge storage fees for holding goods, which can vary based on the size of the space utilised and the duration of storage.

Handling Fees: Fees may be charged for handling the goods, such as loading and unloading, and for any modifications or services performed on the goods (e.g., labelling, packaging, testing).

Customs Bond Costs: A bonded warehouse usually requires a customs bond, which is a financial guarantee to the customs authority that duties will be paid. This bond may involve an upfront fee and annual renewal costs.

Insurance Costs: Businesses may need to insure their goods while stored in the bonded warehouse, which adds to the overall expenses.

Compliance Costs: Ensuring compliance with customs regulations and warehouse management can lead to additional administrative costs, including hiring staff or consulting services.

Opportunity Costs: While using a bonded warehouse allows deferring duty payments, there is a potential cost related to delayed cash flow, especially if the goods remain in storage for extended periods.

Transportation Costs: There may be additional transportation costs involved in moving goods to and from the bonded warehouse, particularly if it's located far from the primary business operations or customer base.

What documentation is required for storing goods in a bonded warehouse?

When storing goods in a bonded warehouse, several essential documents are typically required to ensure compliance with customs regulations and facilitate the storage and handling of goods. Here are the key documents needed:

Import Declaration: This document provides details about the goods being imported, including descriptions, quantities, and values. It is necessary for customs processing.

Bill of Lading: This is a shipping document issued by the carrier that details the type, quantity, and destination of the goods being transported. It serves as a receipt and a contract for transportation.

Customs Bond: A customs bond is a contract between the importer and customs that ensures payment of duties and taxes. It is required for goods stored in a bonded warehouse to guarantee that obligations are met.

Warehouse Receipt: This document is issued by the bonded warehouse operator, acknowledging receipt of the goods and detailing their condition and quantity. It serves as proof of ownership while the goods are in storage.

Commercial Invoice: This document provides information about the sale of the goods and includes details such as the seller’s and buyer’s information, item descriptions, quantities, and prices.

Packing List: This document details the contents of each package, including item descriptions and dimensions. It is useful for inventory management and customs inspections.

Importer Security Filing (ISF): For goods arriving by sea, an ISF may be required to provide U.S. Customs and Border Protection with advance information about the shipment.

End Use Certificate (if applicable): If the goods are subject to specific regulations or restrictions based on their intended use, an end use certificate may be necessary.

Any Specific Permits or Licenses: Depending on the nature of the goods (e.g., alcohol, tobacco), additional permits or licenses may be required.

It’s important to check with local customs authorities and the bonded warehouse operator for any additional documentation or specific requirements that may apply to your situation.

Are there any restrictions on what can be stored in a bonded warehouse?

Yes, there are restrictions on what can be stored in a bonded warehouse. While these warehouses are designed for storing dutiable goods without the immediate payment of duties, certain types of products are typically prohibited or restricted from being stored. Here are some key restrictions:

Perishable Goods: Items that have a limited shelf life, such as food products, cannot be stored

Explosives: Dangerous goods such as explosives are generally not allowed in bonded warehouses due to safety concerns.

Local Goods: Bonded merchandise must be kept separate from goods produced locally in the country, ensuring that imported and domestic products are not intermingled.

Inventory and Record Keeping: Inventory levels of the merchandise stored must be recorded and are subject to regular audits. This requirement imposes a level of control over what can be stored and how it is managed.

Condition of Goods: For goods being imported for repair, they must be in repairable condition and restored to their original state without enhancing their performance.

Legal Compliance: All items must comply with the laws and regulations in the respective country, which can vary in terms of specific restrictions.

Overall, while bonded warehouses offer flexibility for many types of goods, specific items like perishables, explosives, and locally produced goods face restrictions on storage.