While M&A deals are often celebrated as markers of impending growth in the logistics sector, the increasing number of insolvencies suggests that we may be heading into more challenging times for transport and logistics companies, regardless of size.

The logistics and third-party logistics (3PL) sector in the UK is undergoing significant transformation, shaped by mergers and acquisitions at the top of the market, and the increasing insolvency of smaller transport companies. This blog explores these dynamics, delving into their implications for the logistics industry and its customers, and concludes with a look at how the FLOX platform is uniquely positioned to support both ends of the market.

Recent years have witnessed notable mergers and acquisitions (M&A) in the UK's logistics and 3PL sector. Two significant transactions stand out: GXO's purchase of Wincanton and CMA CGM's acquisition of Bolloré Logistics. These moves are reshaping the competitive landscape, presenting both opportunities and threats.

Opportunities: Streamlining Efficiency, Expanding Reach

Mergers and acquisitions can enhance operational efficiency through resource consolidation and elimination of redundancies. For instance, GXO's acquisition of Wincanton is expected to strengthen its service offering, leveraging Wincanton's extensive network within the UK. This consolidation enables providing more comprehensive and efficient customer services, potentially at lower costs due to economies of scale.

Furthermore, these mergers bring about an expansion of service portfolios, facilitating the entry into new markets and service areas. CMA CGM's acquisition of Bolloré Logistics, for example, significantly boosts its capabilities in Africa—a market with booming demand for logistics services.

Challenges: Challenges: Navigating Integration, Ensuring Growth

However, this consolidation also raises concerns over reduced competition, which could lead to higher prices and less choice for customers. Moreover, the integration process following a merger can be complex, risking service disruption and a potential dilution of customer satisfaction.

Post-acquisition of Wincanton, it's anticipated that GXO's share of the UK logistics market will increase by 5%, highlighting the significant consolidation of market power because of the acquisition of Wincanton.

Challenges Leading to Insolvencies Among Smaller Transport Companies

The other end of the spectrum sees smaller transport companies facing a wave of insolvencies. Several challenges contribute to this market trend, including:

- Rising Operational Costs: Increased fuel prices, higher wages, and insurance premiums are squeezing margins. A report by the Road Haulage Association highlighted that fuel costs account for up to 30% of operating costs for haulage companies, a significant burden for smaller operators.

- Regulatory Pressures: Compliance with environmental regulations and safety standards often requires significant investment in newer, greener fleets to reduce carbon footprints, which can be prohibitive for small companies. With less than a year's notice, TFL is introducing new safety standards for vehicles over 12 tonnes. Operators need to make expensive upgrades to vehicles with life cycles of 7+ years.

- Competitive Pressure: The market dominance of larger 3PLs, coupled with their ability to offer more competitive rates due to economies of scale, puts smaller companies at a disadvantage.

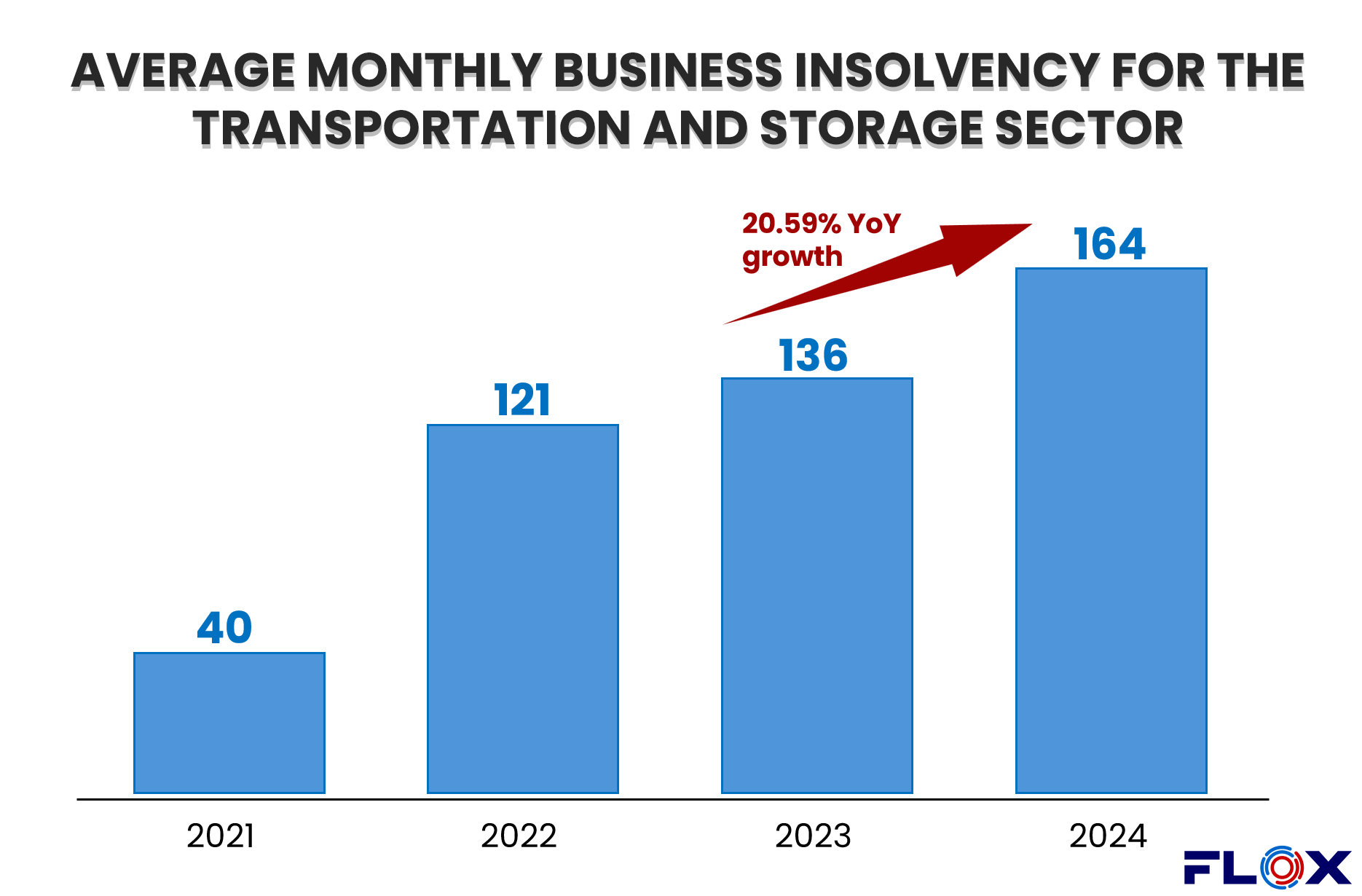

These factors, combined, have led to a notable increase in insolvencies in the sector. For example, in 2023, there was a 20.6% increase in insolvencies among small transport companies in the UK, compared to the previous year, underscoring the severity of the challenges they face.

For SME logistics players, mergers and acquisitions present both a strategic opportunity and a formidable challenge. On one hand, aligning with larger entities or consolidating with peers can offer access to broader networks, advanced technologies such as artificial intelligence and real time tracking, as well as increased capital, potentially alleviating financial pressures and enhancing operational capabilities. On the other hand, SMEs must navigate the complexities of M&A with caution. The potential lack of control, dilution of company culture, and the challenge of integrating into a more complex set of systems can be overwhelming. SME operators must weigh these considerations carefully, ensuring that any M&A activity aligns with their long-term strategic goals and operational capacities, while also preparing for the rigorous and challenging integration process that follows.

(read also: A 2023 Review and 2024 Outlook for the Global Logistics Market)

FLOX: Supporting Both Ends of the Market

In the face of these industry shifts, the FLOX platform emerges as a critical solution. FLOX is designed to match shippers with the excess demand of both large 3PLs and smaller transport companies, facilitating efficient cargo matching and capacity utilisation.

For larger 3PLs, FLOX offers an avenue to optimise their expanded networks post-merger, ensuring that the increased capacity translates to enhanced service offerings for shippers. By efficiently matching demand with available capacity, FLOX helps mitigate the risks of service disruption during the integration phase of mergers and acquisitions.

Simultaneously, FLOX provides a lifeline for smaller transport companies struggling with the challenges outlined earlier. By offering access to a wide range of potential customers and enabling more efficient use of their fleet, FLOX can help these companies improve their load factors and operational efficiencies, thus enhancing their competitiveness and financial viability.

Fostering Resilience in UK Logistics

The UK's logistics and 3PL sector is at a crossroads, with mergers and acquisitions at the top end reshaping the market landscape, and increasing insolvency rates among smaller transport companies highlighting the sector's challenges. While these developments present a mix of opportunities and threats, platforms like FLOX play a pivotal role in ensuring sustainability and market growth. By fostering efficient cargo matching, FLOX supports both the enhanced capabilities of consolidated 3PLs and the survival and competitiveness of smaller transport companies, thus contributing to a more resilient and efficient logistics sector in the UK.

If you don't yet have an account, simply search for Available Storage Capacity or list your Logistics Services with no monthly fees. Sign up for the FLOX platform and start shaping the future of logistics today.

FAQ

What is meant by global logistics?

Global logistics refers to the management and coordination of the flow of goods, services, and information across international borders and through global supply chain operations. It encompasses all the processes involved in planning, implementing, and controlling the efficient movement and storage of goods and related information from the point of origin to the point of consumption on a global scale.

Key factors in global logistics include:

1. Transportation International Shipping: Movement of goods via air, sea, rail, or road across countries and continents.

2. Multimodal Transport: Combining multiple modes of transportation to optimise cost and time. Last-mile Delivery: Ensuring goods reach their final destination.

3. Customs and Compliance Navigating customs regulations and ensuring compliance with international trade laws: Handling documentation, tariffs, and duties.

4. Warehousing and Distribution Storing goods at strategic locations around the world for timely distribution. Setting up regional distribution centres to meet local market demands.

5. Supply Chain Management: Coordinating suppliers, manufacturers, distributors, and retailers across different countries. Managing inventory levels and optimising procurement and production schedules.

6. Technology and Data Management: Using software tools like transportation management systems (TMS) and enterprise resource planning (ERP) systems to track shipments and inventory in real time. Leveraging big data and analytics for demand forecasting and logistics optimisation.

7. Challenges and Risks: Dealing with geopolitical risks, such as trade wars or sanctions. Managing environmental and sustainability concerns in transportation and packaging. Addressing logistical complexities caused by differing infrastructures, cultural factors, and time zones.

8. Global Trade and Market Integration: Supporting businesses in entering new markets by ensuring the availability of products worldwide. Facilitating the movement of raw materials and finished goods necessary for global manufacturing and trade. In essence, global logistics is the backbone of international trade, ensuring that goods can be transported efficiently, cost-effectively, and in compliance with global regulations.

What is the largest logistics market in the world?

The largest logistics market in the world is the Asia-Pacific region, which has established itself as a dominant force in the global logistics landscape. This region encompasses major economies such as China, India, Japan, South Korea and Australia, all of which have witnessed significant advancements in logistics infrastructure, technology integration, and e-commerce growth. The rapid urbanisation and increasing consumer demand in these countries have resulted in a surge in logistics activities, making Asia-Pacific an attractive hub for logistics operations. Companies operating in this space are leveraging advanced technologies, such as data analytics and automation, to enhance their supply chain efficiency and meet the rising demand for logistics services.

Several factors contribute to Asia-Pacific's status as the largest logistics market. First, the region has experienced remarkable growth in the e-commerce sector, with the number of online shoppers expected to double in the coming years. This growth creates an ever-increasing need for logistics services to facilitate the movement of goods and ensure timely delivery to consumers. The region's strategic geographical position also serves as a critical link for international trade, facilitating the smooth movement of goods across borders. The investment in logistics infrastructure, such as ports, warehouses, and transportation networks, further solidifies Asia-Pacific's position at the forefront of the global logistics industry.