While M&A deals are often celebrated as markers of impending growth in the logistics sector, the increasing number of insolvencies suggests that we may be heading into more challenging times for transport and logistics companies, regardless of size.

A Deep Dive into Mergers, Acquisitions, and Insolvencies

The logistics and third-party logistics (3PL) sector in the UK is undergoing significant transformation, shaped by mergers and acquisitions at the top of the market, and the increasing insolvency of smaller transport companies. This blog explores these dynamics, delving into their implications for the industry and its customers, and concludes with a look at how the FLOX platform is uniquely positioned to support both ends of the market.

The Impact of Mergers and Acquisitions

Recent years have witnessed notable mergers and acquisitions (M&A) in the UK's logistics and 3PL sector. Two significant transactions stand out: GXO's purchase of Wincanton and CMA CGM's acquisition of Bolloré Logistics. These moves are reshaping the competitive landscape, presenting both opportunities and threats.

Opportunities: Streamlining Efficiency, Expanding Reach

Mergers and acquisitions can lead to enhanced operational efficiency through the consolidation of resources and elimination of redundancies. For instance, GXO's acquisition of Wincanton is expected to strengthen its service offering, leveraging Wincanton’s extensive network within the UK. This consolidation enables the provision of more comprehensive and efficient services to customers, potentially at lower costs due to economies of scale.

Furthermore, these mergers bring about an expansion of service portfolios, facilitating the entry into new markets and service areas. CMA CGM's acquisition of Bolloré Logistics, for example, significantly boosts its capabilities in Africa—a market with booming demand for logistics services.

Challenges: Challenges: Navigating Integration, Ensuring Growth

However, this consolidation also raises concerns over reduced competition, which could lead to higher prices and less choice for customers. Moreover, the integration process following a merger can be complex, risking service disruption and a potential dilution of customer focus.

Post acquisition of Wincanton, it’s anticipated that GXO’s share of the UK logistics market will increase by 5%, highlighting the significant consolidation of market power because of the acquisition of Wincanton.

Challenges Leading to Insolvencies Among Smaller Transport Companies

The other end of the spectrum sees smaller transport companies facing a wave of insolvencies. Several challenges contribute to this trend, including:

- Rising Operational Costs: Increased fuel prices, higher wages, and insurance premiums are squeezing margins. A report by the Road Haulage Association highlighted that fuel costs account for up to 30% of operating costs for haulage companies, a significant burden for smaller operators.

- Regulatory Pressures: Compliance with environmental regulations and safety standards often requires significant investment in newer, greener fleets and training, which can be prohibitive for small companies. With less than a year’s notice, TFL are introducing new safety standards for vehicles over 12 tonnes. Operators need to make expensive upgrades to vehicles with life cycles of 7+ years

- Competitive Pressure: The market dominance of larger 3PLs, coupled with their ability to offer more competitive rates due to economies of scale, puts smaller companies at a disadvantage.

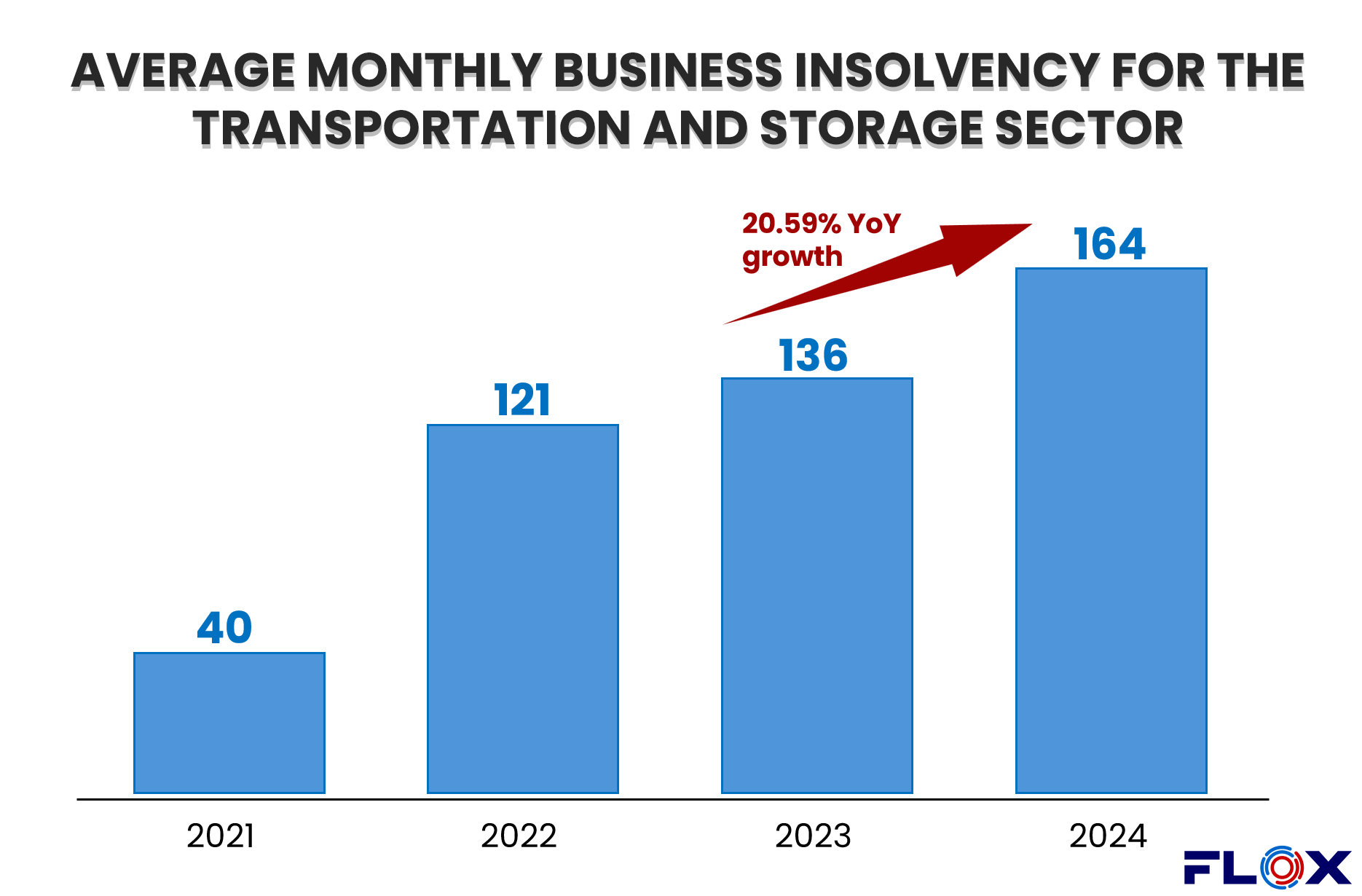

These factors, combined, have led to a notable increase in insolvencies in the sector. For example, in 2023, there was a 20.6% increase in insolvencies among small transport companies in the UK, compared to the previous year, underscoring the severity of the challenges they face.

For SME logistics players, mergers and acquisitions present both a strategic opportunity and a formidable challenge. On one hand, aligning with larger entities or consolidating with peers can offer access to broader networks, advanced technologies, and increased capital, potentially alleviating financial pressures and enhancing operational capabilities. On the other hand, SMEs must navigate the complexities of M&A with caution. The risk of losing autonomy, dilution of company culture, and the challenge of integrating into a more complex set of systems can be overwhelming. SME operators must weigh these considerations carefully, ensuring that any M&A activity aligns with their long-term strategic goals and operational capacities, while also preparing for the rigorous and challenging integration process that follows.

(read also: A 2023 Review and 2024 Outlook for the Global Logistics Market)

FLOX: Supporting Both Ends of the Market

In the face of these industry shifts, the FLOX platform emerges as a critical solution. FLOX is designed to match shippers with the excess demand of both large 3PLs and smaller transport companies, facilitating efficient cargo matching and capacity utilisation.

For larger 3PLs, FLOX offers an avenue to optimise their expanded networks post-merger, ensuring that the increased capacity translates to enhanced service offerings for shippers. By efficiently matching demand with available capacity, FLOX helps mitigate the risks of service disruption during the integration phase of mergers and acquisitions.

Simultaneously, FLOX provides a lifeline for smaller transport companies struggling with the challenges outlined earlier. By offering access to a broader base of potential customers and enabling more efficient use of their fleet, FLOX can help these companies improve their load factors and operational efficiencies, thus enhancing their competitiveness and financial viability.

Fostering Resilience in UK Logistics

The UK's logistics and 3PL sector is at a crossroads, with mergers and acquisitions at the top end reshaping the market landscape, and increasing insolvency rates among smaller transport companies highlighting the sector's challenges. While these developments present a mix of opportunities and threats, platforms like FLOX play a pivotal role in ensuring the sustainability and growth of the sector. By fostering efficient cargo matching, FLOX supports both the enhanced capabilities of consolidated 3PLs and the survival and competitiveness of smaller transport companies, thus contributing to a more resilient and efficient logistics sector in the UK.

If you don't yet have an account, simply search for Available Storage Capacity or list your Logistics Services with no monthly fees.

Sign up for the FLOX platform and start shaping the future of logistics today.